Years ago, bank heists and robbery with violence were some of the most chilling encounters anyone would dread coming face-to-face with. Fast-forward, and a few decades later, determined criminals have graduated to a more unobtrusive, stealthy and sly method of reaping where they didn’t plant. The aftermath of this new ‘approach,’ unlike the old common theft, can send shockwaves in the victim’s life as far as several decades later, severely affecting their creditworthiness and generally disrupting their social and financial health. Welcome to the new-age identity theft that is increasingly becoming commonplace even as we embrace a more digitalized economy.

But how can you protect yourself from falling victim to the latest scams perpetrated by these tech-savvy cybercriminals? Here’s how.

1. Get into the habit of shredding or physically expunging all sensitive documents containing your financial information. In a world that nearly all-physical data is typically backed up from the source, holding copies of the same information only predisposes you to identity theft. This mostly applies to your social security number, bank account details, 16-digit credit card number among others. Shred or encrypt everything, particularly the forms you use to apply for a Social Security card.

2. Lock your passports, credit/debit cards that you rarely use and other sensitive documents in a safe not-easily-accessible place. Also, avoid carrying cards that you barely or don’t use in your purse or wallet. The fewer documents on you at any given time, the lower your chances of losing them accidentally or incidentally.

3. Change your PINs and bank account login details at least once every three months. This might seem unnecessary, but you will thank yourself one day in the aftermath of a wide-scale cyber hack. In line with this, it pays to run a check of any security breaches with your bank or credit card issuer at least once every month.

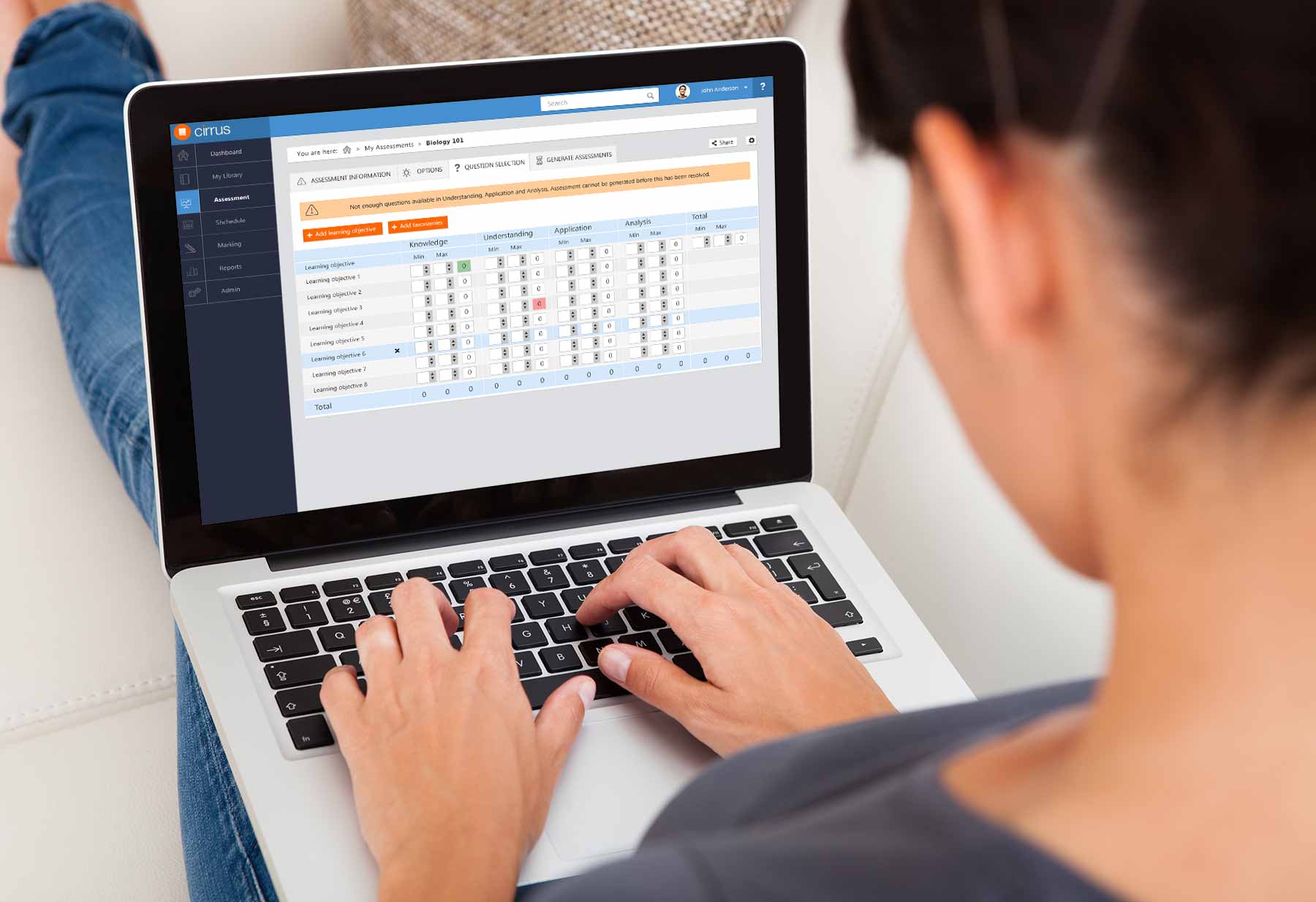

4. Keep your computer’s anti-virus software and spyware program up-to-date especially if you have already subscribed to online banking. You may not realize this, but nowadays a laptop P.C is the biggest hub of anyone’s personal information that a malicious hacker needs to do a thorough job cleaning up their accounts.

5. Minimize/limit the Number of People with your Personal Information. You don’t need to include your social security number on your resume or job application pack. Similarly, never expose your financial details on an online survey regardless of how reputable the source seems.

6. Lock your mailbox and collect your mail as often as possible. Most banks will usually send their customers a monthly or annual credit card history or statement at the end of every month or fiscal year. These sensitive documents shouldn’t sit in your mailbox for more than a day.

7. On a similar note, contact your postal service immediately should you notice a major change in the frequency of your mails. This includes if you stop receiving your magazine subscriptions or any other recurrent mail, it eliminates the chances of an identity thief setting up a mail-forwarding request without your knowledge.

In conclusion

Your average criminal is no longer a gun totting, semi-literate, quick-paced fellow, but a bright, resourceful and computer-savvy figure who can ruin your financial life and cause you untold pain within seconds of accessing your personal information. So keep it private, won’t you?